Agility and adaptability are the very fabric of success of SaaS organisations, which makes Oracle NetSuite the ideal business engine. By offering a cloud-based, all-encompassing business management solution, NetSuite provides the agility to pivot and the adaptability to evolve – essential attributes in the fast-paced SaaS sector.

From its early beginnings in the late nineties, NetSuite was founded on the principles of the cloud – long before the idea of the ‘cloud’ existed. Its evolution has been a testament to its adaptability, growing from a business tool for financials to a robust platform that spans CRM, eCommerce and beyond – and a true ally for SaaS models that thrive on subscription-based frameworks and continuous innovation.

The tech and SaaS sector in Australia

The tech sector is growing fast in Australia. In fact, it’s one of the fastest-growing sources of jobs, opportunity, and economic growth in Australia*. But these successes can only be accelerated through a systematic and considered approach to growing the Australian tech ecosystem, and the best place to start is with each company’s core engines of growth – those internal gears and levers that are best able to support these companies as they make their way onto the global stage.

More resources on the Australian SaaS sector:

The 4 things that top tech companies are prioritising right now >

What your business can learn from the big players in digital >

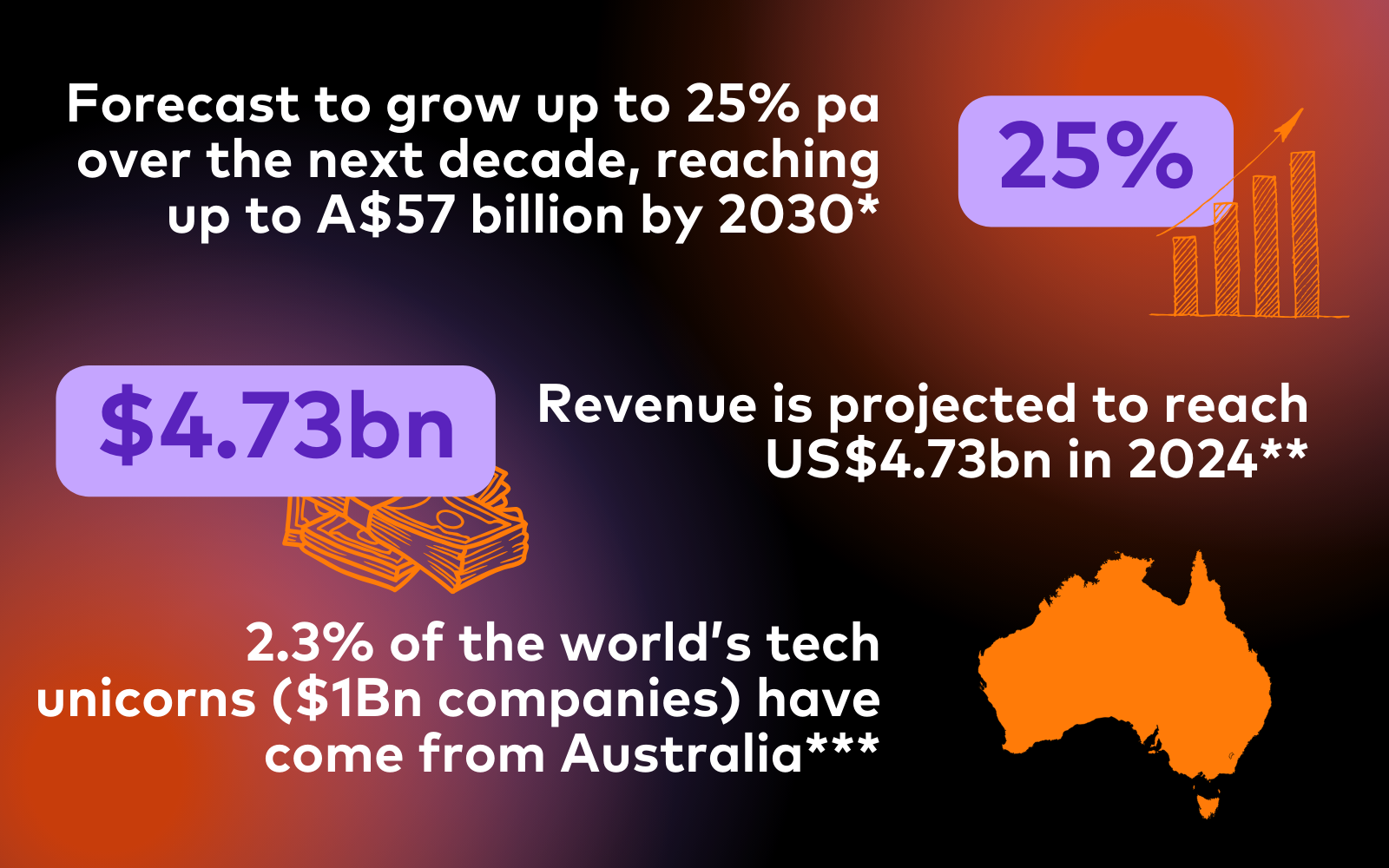

Key stats on the Australian SaaS sector

* Invest Victoria

** Statista

*** Tech Council of Australia

NetSuite alignment with SaaS companies

NetSuite, SaaS, and adaptability

NetSuite is designed to be as adaptable as the software companies it supports. There are customisable modules, robust APIs, applications, and limitless ERP integration options to ensure that whatever direction your SaaS business takes, your business management solution can adapt at pace.

NetSuite, SaaS, and efficiency

The operational demands of a SaaS company are unique and evolving. NetSuite caters to this by offering software companies streamlined processes across finance, CRM, and supply chain, ensuring that operational efficiency continues even as complexity grows. This means less time spent on administrative tasks and more on strategic initiatives that drive business growth.

NetSuite, SaaS metrics, and strategic decision-making

Beyond operational efficiency, NetSuite brings strategic insights to the table through its advanced data analytics and business intelligence capabilities. For SaaS companies where strategic decisions must be data-driven, NetSuite acts both as a tool and as a partner, providing the insights necessary to make those crucial calls that determine market positioning and competitive edge.

Learn more about NetSuite-supported KPIs for SaaS:

Key financial and other metrics SaaS businesses must track >

7 important operational metrics to track in SaaS >

Understanding NetSuite’s Core Offerings for SaaS and software companies

ERP (Enterprise Resource Planning)

At the heart of NetSuite’s suite lies its ERP system, which integrates various functions – finance, HR, procurement, projects, and more – into a unified program. This centralisation simplifies and automates day-to-day business activities, fostering efficiency and providing real-time visibility into essential operations.

Customer Relationship Management (CRM)

NetSuite’s CRM module goes beyond managing contacts and sales pipelines to enhance interactions with clients and prospects. It can help you track customer histories, analyse purchasing patterns and behaviour, and uncover insights to tailor engagement strategies and drive sales growth.

Learn more about how customer success drives competitive advantage for Australian SaaS companies >

Professional Services Automation (PSA)

NetSuite can also optimise the delivery of professional services. By automating tasks such as project management, resource allocation, and time and expense tracking, it enables services firms to improve project margins and on-time delivery.

eCommerce solutions

NetSuite’s e-commerce capabilities support a seamless, omnichannel approach that spans online, in-store, and mobile. From inventory management to integrated web stores, these tools help businesses provide a consistent shopping experience, manage transactions efficiently, and increase customer satisfaction.

Financial management

At its financial core, NetSuite provides extensive features for financial tracking, analysis, and reporting. It offers robust forecasting and budgeting tools that help businesses plan for the future with precision. The financial reporting capabilities are comprehensive, ensuring compliance and providing stakeholders with a clear view of the company’s financial health.

SaaS-friendly modules that build on core NetSuite functionality

SuiteBilling: Subscription billing software for NetSuite

SaaS business models typically rely on subscription billing, and the NetSuite SuiteBilling module is the best subscription billing software for NetSuite customers. It’s a native module designed specifically to address the billing challenges faced by businesses with subscription-based models.

The module provides transparency around all billing activities, including:

- Consolidated billing statements including single purchases, project fees, and recurring subscription costs

- Automated adjustments for subscription and pricing modifications, scheduled ahead with prorated calculations effective from designated dates

- Subscription billing in multiple currencies to accommodate global transactions

- Access to real-time reporting and analytics, complete with comprehensive audit trails and monitoring of modifications

- Versatile subscription configurations adaptable to broad or individual customer needs, with a range of pricing structures including volume-based, tiered, and fixed rates

For SaaS companies continuing to rely on a combination of manual processes, spreadsheets, and basic accounting or ERP systems, NetSuite paired with SuiteBilling supports complex billing requirements and automates revenue recognition processes to more than accommodate their needs.

Learn more about SuiteBilling for SaaS companies >

NetSuite Advanced Financials

NetSuite Advanced Financials offers complementary financial management functionality for NetSuite, including budgeting, expense allocations and amortisation, flexible billing management, and statistical accounts. For SaaS companies seeking outside investment or to go public, this level of robust accounting and reporting capabilities is particularly critical.

Scalability for growing SaaS businesses

Support across business stages

NetSuite’s architecture is designed to support SaaS organisations from their nascent stage through to public offering and beyond. As the organisation transitions from attracting early adopters to expanding its market share, NetSuite’s systems can facilitate this growth without the need for costly upgrades or migrations.

Handling increased transactions and complexity

Another core strength of NetSuite for SaaS businesses is its ability to handle increasing transaction volumes and the accompanying complexity. Unlike other smaller systems, Xero or MYOB for example, NetSuite scales with growth. Whether it’s a surge in customer numbers, a spike in transaction frequency, or the diversification of service offerings, NetSuite’s cloud infrastructure and modular design mean that additional capacity and functionality is automatically added without disruption.

Global financial capabilities for borderless business

Multi-currency and multi-subsidiary management

The ability to operate seamlessly across borders is a significant advantage. NetSuite OneWorld provides essential multi-currency and multi-subsidiary management capabilities, allowing businesses to effortlessly manage global operations. These capabilities simplify the complexities associated with foreign exchange rates, consolidates financials across different entities, and provides a unified view of global operations.

Compliance and reporting

For SaaS businesses that operate on an international scale, compliance and reporting capabilities will be essential growth ingredients. NetSuite ensures that businesses remain compliant with various international financial regulations and standards. Its reporting tools are designed to meet the stringent requirements of financial reporting and compliance.

Integration of front and back-office processes

NetSuite’s integration of front and back-office processes enables SaaS businesses to streamline their operations, from customer relationship management to order management and fulfilment, all the way through to financials and after-sales support. By bringing these disparate functions together, NetSuite helps SaaS businesses to focus on innovation and growth, while reducing the overheads associated with managing multiple, disconnected systems.

The main revenue management challenges for tech companies and how to solve them >

Are you a FinTech? Here’s how to grow your fintech business with an ERP >

What about fintech and NetSuite?

Fintech firms face the twin tasks of creating essential and profitable products amidst challenges like securing investment, customer management, regulatory compliance, and innovation. Oracle NetSuite provides the ideal solution for fintech businesses with its cloud-based suite, facilitating product profitability insights, efficient development, global expansion, and reduced IT costs, alongside strong governance tools. By adopting NetSuite’s ERP solutions, fintechs can navigate these obstacles, scaling and innovating to maintain a competitive edge in a heavily invested industry.

Learn more about a NetSuite implementation for fintech

Or explore more resources on the Australian fintech sector:

The trends giving rise to Australian fintech unicorns >

The future of fintech in Australia >

NetSuite for startups

NetSuite offers startups a transformative cloud-based ERP solution tailored to the needs of their emerging business. By integrating financial, customer, and operational management in a single platform, NetSuite provides startups with the agility to adapt to market changes, scale efficiently, and drive growth. With features designed to address the financial complexities and dynamic environments that startups navigate, NetSuite for startups enables these burgeoning companies to streamline their operations, gain real-time insights into their performance, and focus on innovation.

Legacy system limitations

Legacy systems are any outdated technology that is preventing a company’s growth and operational efficiency. These systems usually suffer from integration issues – they may not communicate seamlessly with newer applications, leading to data silos. They also struggle to scale with growing business demands and generally fail to provide the real-time analytics necessary for agile decision-making in today’s fast-paced digital environment.

A legacy system can refer to a variety of outdated IT solutions that a company might be using. This can include on-premise ERP systems that are often inflexible and not integrated with modern cloud services, a basic accounting program that lacks the features and scalability required for growing businesses, or even a disjointed set of applications and spreadsheets that require manual intervention and don’t communicate with each other effectively.

Learn more about how investing in NetSuite can help you sunset your legacy systems >

When is the right time to invest in a cloud ERP?

There are several indicators that a move to a more powerful solution is necessary:

- Decreased productivity and complex workarounds due to system constraints

- Running on multiple siloed systems

- Increased legacy system maintenance costs

- An inability to meet customer expectations with current capabilities

- Data remains isolated and incompatible with other systems

- Limited support for scale and growth

- You’re falling out of compliance with modern information security standards

- Your older or outdated hardware has stopped receiving security updates

When these issues start to emerge, it’s clear that the legacy system is no longer a help, it’s a hindrance.

Learn more about Running on Xero? Here’s why growing businesses level up with NetSuite >

Learn more about 4 reasons why you should invest in an ERP system >

Planning the transition to NetSuite cloud ERP

A successful transition requires secure buy-in from all stakeholders and clear objectives that align with the company’s vision. The plan should encompass a detailed timeline that accounts for all the phases of transition, including system setup, data migration, and staff training, to ensure that the new system is up and running without significant downtime.

A phased approach

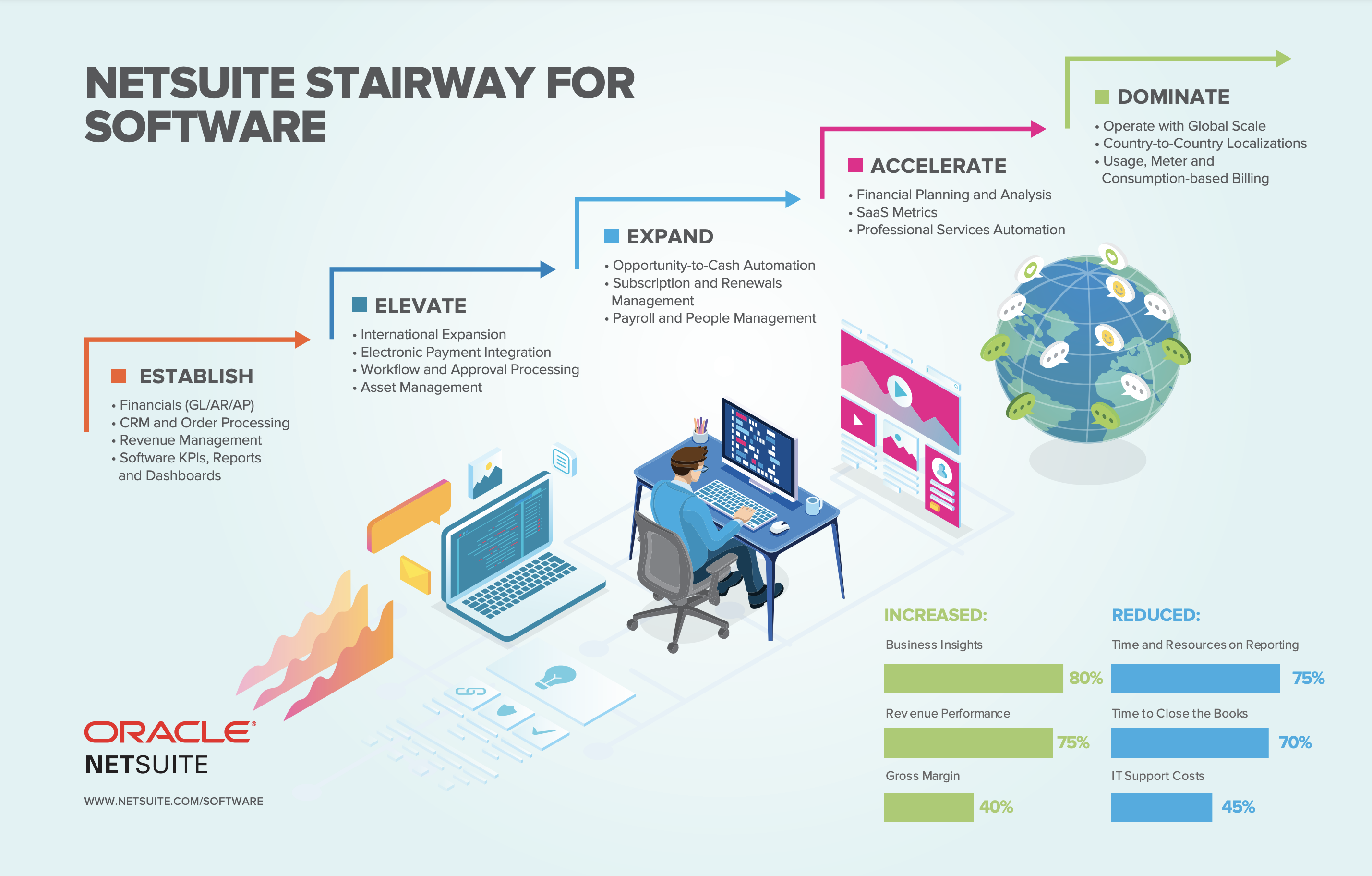

You can minimise operational disruption by implementing a phased rollout to gradually acclimatise different departments to the new system. NetSuite offers the SuiteSuccess pathway which provides a strategic progression to enhance business performance. It starts with real-time insights and financial automation, progresses to streamlined billing, subscription, and renewal processes, and prepares businesses for global growth. Finally, it enables companies to enhance customer value through predictive analytics and upsell opportunities, while also focusing on cost reduction.

The business value of SuiteSuccess

.png)

An end-to-end implementation

While this approach extends the time to value and implementation timeline, it will ensure a comprehensive and deeply integrated system setup. This method involves a detailed analysis of current processes, meticulous planning, and the deployment of all selected NetSuite modules in a unified manner to fully replace legacy systems. It allows for thorough testing, training, and adjustment phases, ensuring that the transition is smooth and that the new system aligns perfectly with business needs, ultimately leading to a more robust and efficient operational framework.

Learn more about Infographic: SuiteSuccess Vs agile implementation – which is right for you? >

Tips for transitioning to a cloud ERP

- Select an implementation partner with proven experience in the SaaS sector so that the NetSuite instance is grounded in industry-specific insights and best practices

- Maintain the legacy system in tandem with NetSuite temporarily to guarantee uninterrupted business processes

- Plan the transition for periods of low activity to lessen the impact on daily operations

- Monitor each phase to address issues promptly, maintaining operational continuity

Learn more:

Your guide to successfully navigating a NetSuite implementation >

The complete guide to selecting a NetSuite implementation partner >

What to look for in a NetSuite implementation partner >

Case studies: SaaS companies growing with NetSuite

Splitit: Global digital payments fintech expands and scales with Annexa

To support the business through high growth, global payment solution provider Splitit was ready to introduce automated processes, optimised financial reporting, and improved visibility supported by NetSuite and Annexa.

Virtually Human Studio (VHS): VHS gallops ahead with NetSuite-enabled crypto processing

When this Australian digital-first company – a trailblazer in blockchain-driven immersive entertainment – partnered with Annexa to implement NetSuite, they transformed their financial operations with seamless cryptocurrency processing. With over 13,000 cryptocurrencies tracked, VHS is now ideally positioned for scalable growth and expansion.

Scale your SaaS business with Annexa + NetSuite

Annexa is your trusted NetSuite partner in sales, implementation, development, and support across Australia and New Zealand. Whether your needs are for order management, supply chain, payroll, warehouse management, or all of the above, connect with us for more information.